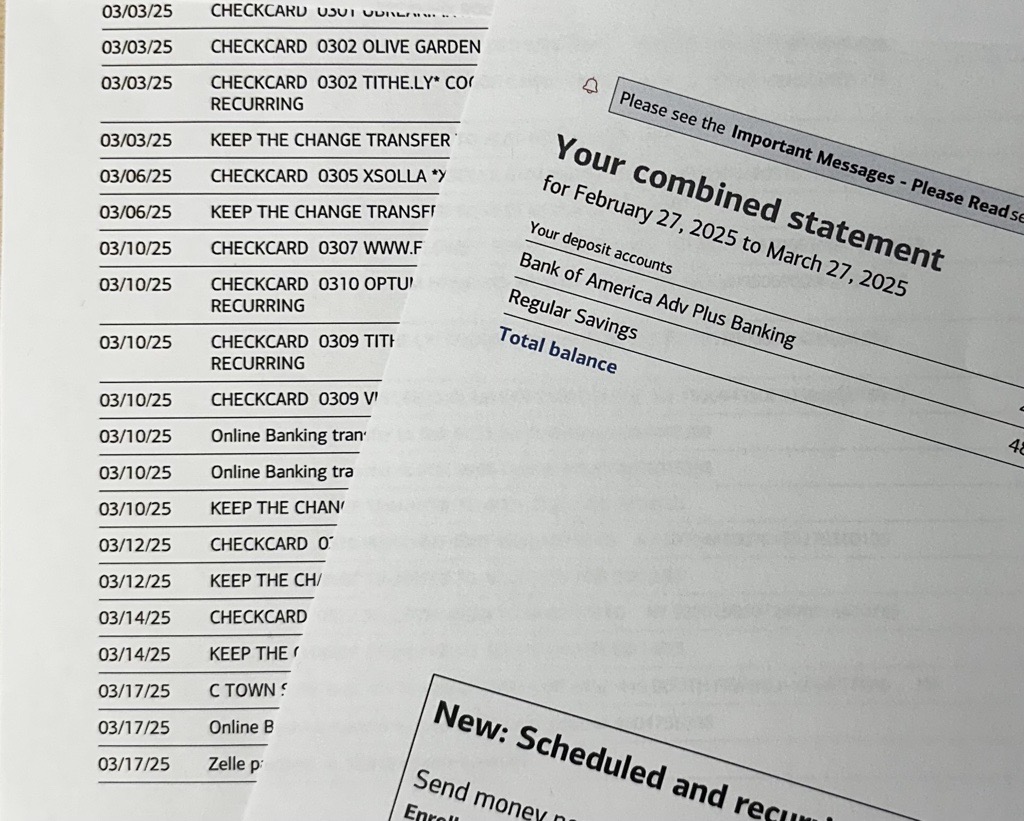

Bank Statement Only Financing

Self-employed borrowers, as well as those who earn seasonal income, may be eligible to qualify for a bank statement loan program. Bank statement loans allow you to use your bank statements to verify income instead of tax returns. These programs are utilized by a wide range of self-employed professionals, including small business owners, freelancers, independent contractors, and many other types of self-employed people.

How do bank statement loans work?

With bank statement loans, the lender uses bank statements to analyze a borrower’s income instead of using standard documentation. Lenders that offer bank statement loan programs will look at a borrower’s bank over a 12 to 24 month time period to determine the borrower’s net income, which is the amount of money earned after the borrower has paid taxes and business-related expenses

How can you qualify?

The qualifications for a bank statement loan may vary by lender. But in general, a borrower is required to have at least two years of self-employed income and business experience. Once a lender has determined income, they will decide the maximum loan amount allowed. This is based on the borrower’s debt-to-income ratio, a percentage of the monthly income that goes towards paying any debt they may have, including a mortgage.